With IR35 on its way, contractors and self-employed wonder if they will still be able to claim expenses through an Umbrella company. And the answer is... long and it deserves a blog post!

In this post, we will cover in simple terms everything you need to know about expenses if you are an Umbrella Worker!

Let’s get started! 🙂

What are Chargeable Expenses

What are Chargeable Expenses?

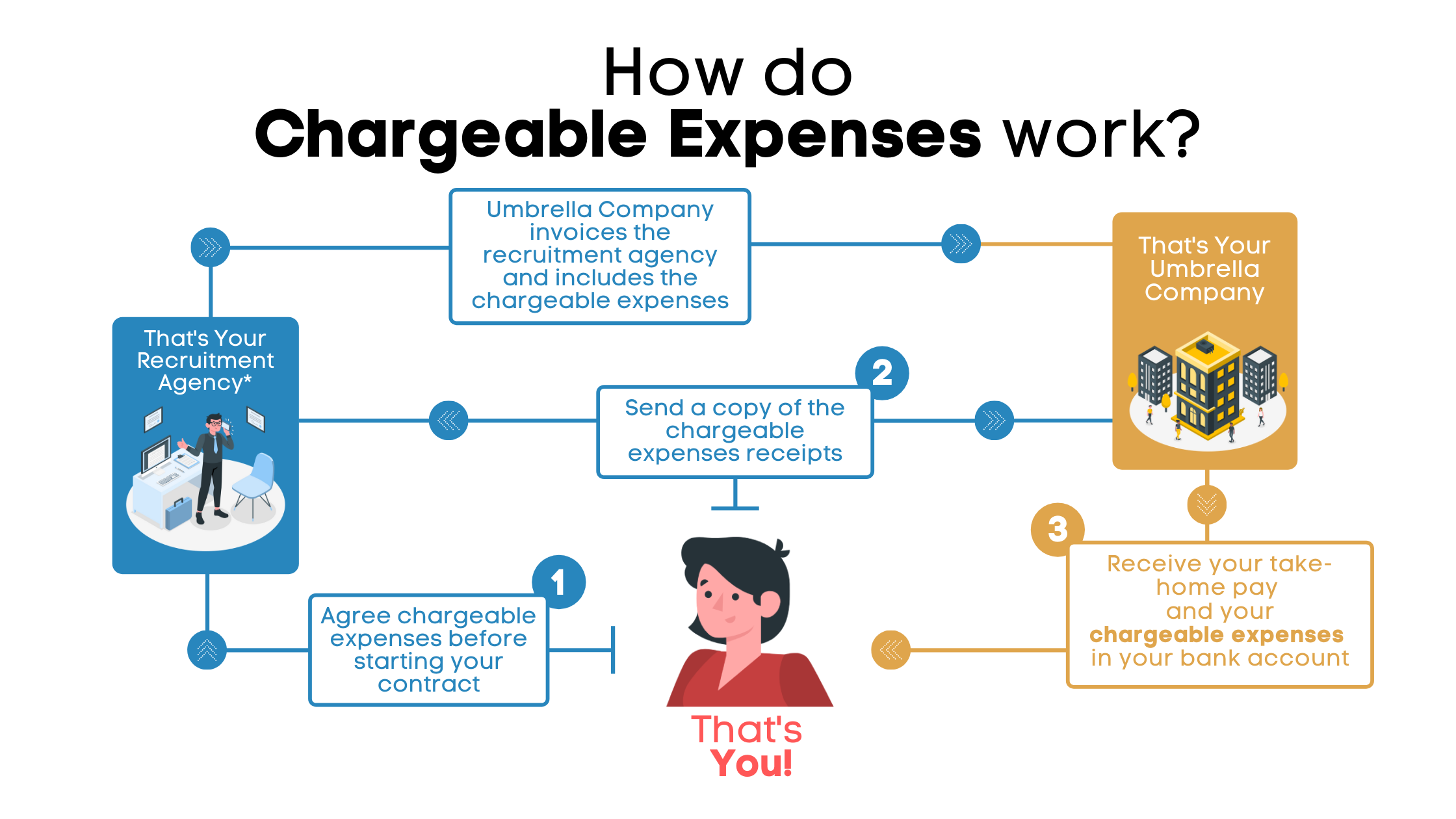

Chargeable - or Rechargeable - expenses are specific expenses that your recruitment agency or your end client agreed to reimburse you. They are added on top of your salary each time your umbrella company process your pay.

Do I pay tax on Chargeable Expenses?

No. Your Umbrella Company will receive an additional payment from your recruitment agency or your end-client. You will then receive the full value of the expense back alongside your pay.

Expense Allowance

It is also possible than the end-client or recruitment agency provides you with an expense allowance. If the full allowance is not used, the part left will be considered as taxable benefits and will be subject to income tax. Expense allowances are generally a recurring payment. E.g. £175/week for accommodation.

Will I have any paperwork to do?

Yes, but it is very minimal. You should ensure to keep all your receipts for all your claims. Make sure you provide the Umbrella Company or/and the Recruitment agency with a copy of the receipts and to keep the originals.

You prefer to have a visual? No worries we got you covered 🙂

What are Business Expenses for Employees (Tax-Deductible Expenses)

What are Tax Deductible Expenses?

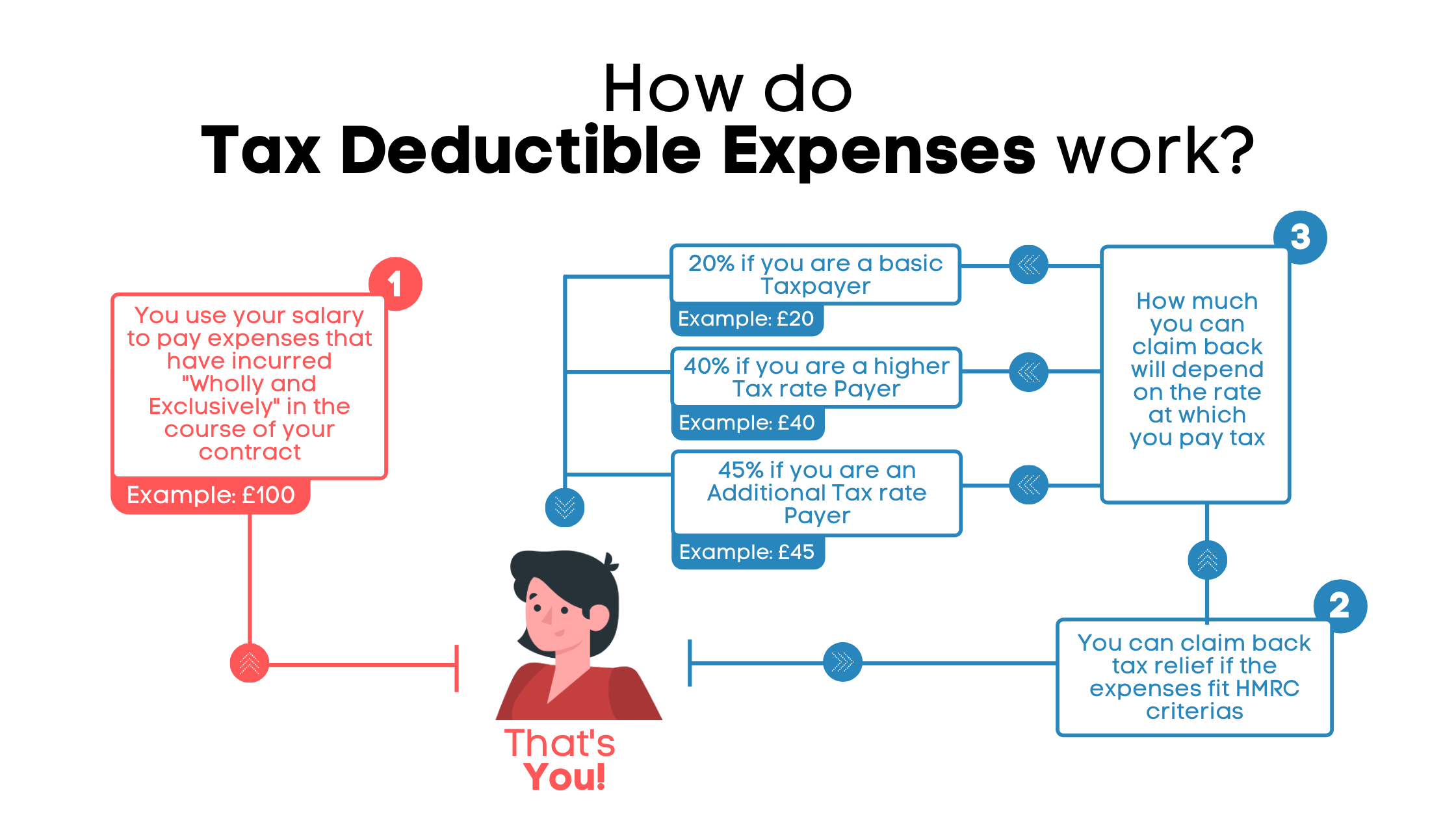

Business expenses are expenses you have incurred “Wholly and Exclusively” in the course of your contract.

For clarity, we will refer in this article to business expenses as non-chargeable expenses. Non-chargeable expenses haven’t been agreed to be reimbursed by the end-client or the recruitment agency. However, they might be Tax Deductible.

You might be able to claim tax relief on these expenses if:

- You use your own money for things that you must buy for your job.

- You only use these things for your work.

- Your employer hasn’t reimbursed you

- Your employer hasn’t provided you with an alternative

Source HMRC

What are tax-reliefs on expenses? In this context, Tax relief means that you can get back the income-tax on the total amount you paid for these expenses. The percentage you will be able to claim back depends on the rate at which you pay income tax:

- Basic Taxpayer will be able to claim 20% of the expenses

- Higher Tax rate Payer will be able to claim 40% of the expenses

- Additional tax ratepayer will be able to claim 45% of the expenses

Tax-deductible expenses are income-tax-free for everyone, so if you are taxed more, you will get back more.

How to claim tax relief on tax-deductible expenses

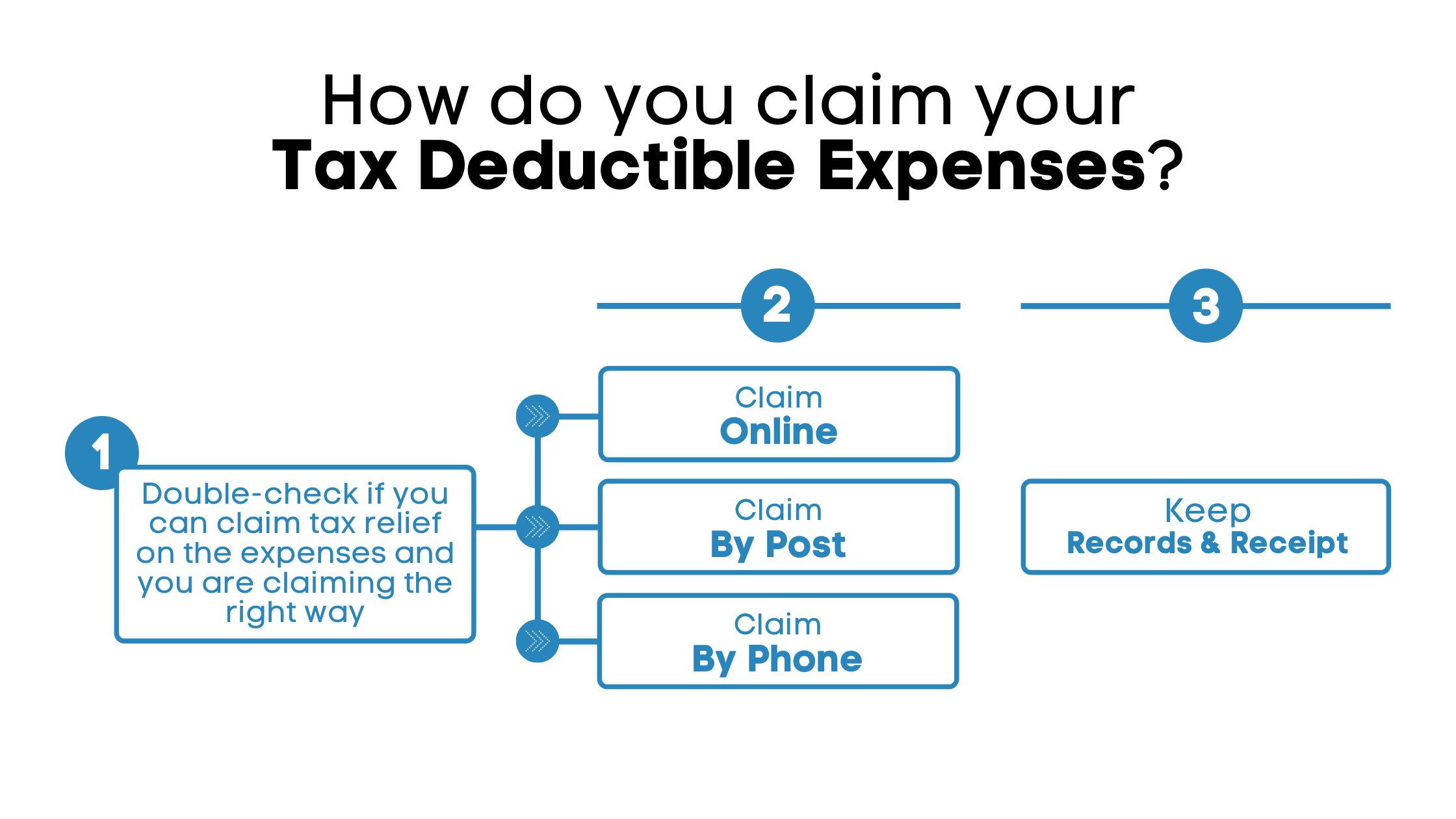

Before to Claim tax relief on your job expenses

Firstly, you should double-check if you can claim tax relief on the expenses. HMRC put in place an easy process to check it out on the gov.uk: Check if you can claim work related expenses page.

Once you confirmed you could claim tax relief of your expenses, you can choose three different ways to do so:

- Claim Online

- Claim by post

- Claim by phone

Claim Online

To claim your expenses online use the gov.uk: Claim tax relief for your job expenses page. You will be given a reference number. Make sure you keep it to track the progress of your form.

You should include all expenses for the tax year you want to claim. Source: HMRC

Claim by post

You must use this form if you’re claiming either:

- on behalf of someone else

- relief for more than five different jobs

You can access the form on HMRC website on the gov.uk: Claim Income Tax relief for your employment expenses (P87) guidance page.

Advice if you decide to claim by post:

Make sure you include anything you want to claim tax relief for. Make sure you fill the form fully before printing it. You won’t be able to save halfway. If the form is not uploading correctly you should look at updating your browser. HMRC also covered this eventuality on their gov.uk: Browsers page.

Claim by phone

You can claim by phone if you’ve already claimed expenses in a previous year and your total expenses are less than either:

- £1,000

- £2,500 for professional fees and subscriptions

You can call HMRC, Monday to Friday between 8 AM and 6 PM.

- 0300 200 3300

- +44 135 535 9022 from Outside the UK

Advice if you decide to claim by phone:

- HMRC use speech recognition software, so make sure you answer questions with short phrases and words.

- Call before 10 AM. It is usually less busy.

Special treatment for Travel and Subsistence Expenses

What are Travel and Subsistence Expenses

Travel & Subsistence are a type of expenses. Please find below a non-exhaustive list of Travel & Subsistence Expenses (T&S).

- Mileage

- Accommodation

- Meals

- Parking charges

- Tolls

- Congestion charges

- Business phones calls

What HRMC say about Travel and Subsistence Expenses

Since the 6th of April 2016, a contractor engaged through an intermediary (Umbrella Companies, Recruitment agencies, ...) won’t be able to claim tax relief on travel and subsistence expenses.

However, HMRC created an exception. If the contractor is not subject to Supervision, Director and Control (SDC), they will still be able to claim expenses.

We will cover everything you need to know about SDC in a dedicated post.

The post is live here: What is Supervision, Direction and Control (SDC)? How does it affect expenses for contractors?. Go check it out! 😉

Conclusion

To conclude: Yes, you can claim tax relief when you are working through an Umbrella Company. However, as you can see, there are few requirements to follow.

Luckily, HMRC put in place several tools to help you determine accurately if you will be able to claim income tax back on your job expenses.

We hope our article helped you! Let us know what you think!