Since 2016, HMRC changed the treatment of travel and subsistence expenses for contractors and self-employed who work through employment intermediaries such as Umbrella Companies.

The legislation is complex and subject to interpretation and we will cover everything you need to know about the Supervision, Direction and Control and how it affects contractors, freelancers and self-employed.

Let’s dive into it! 🙂

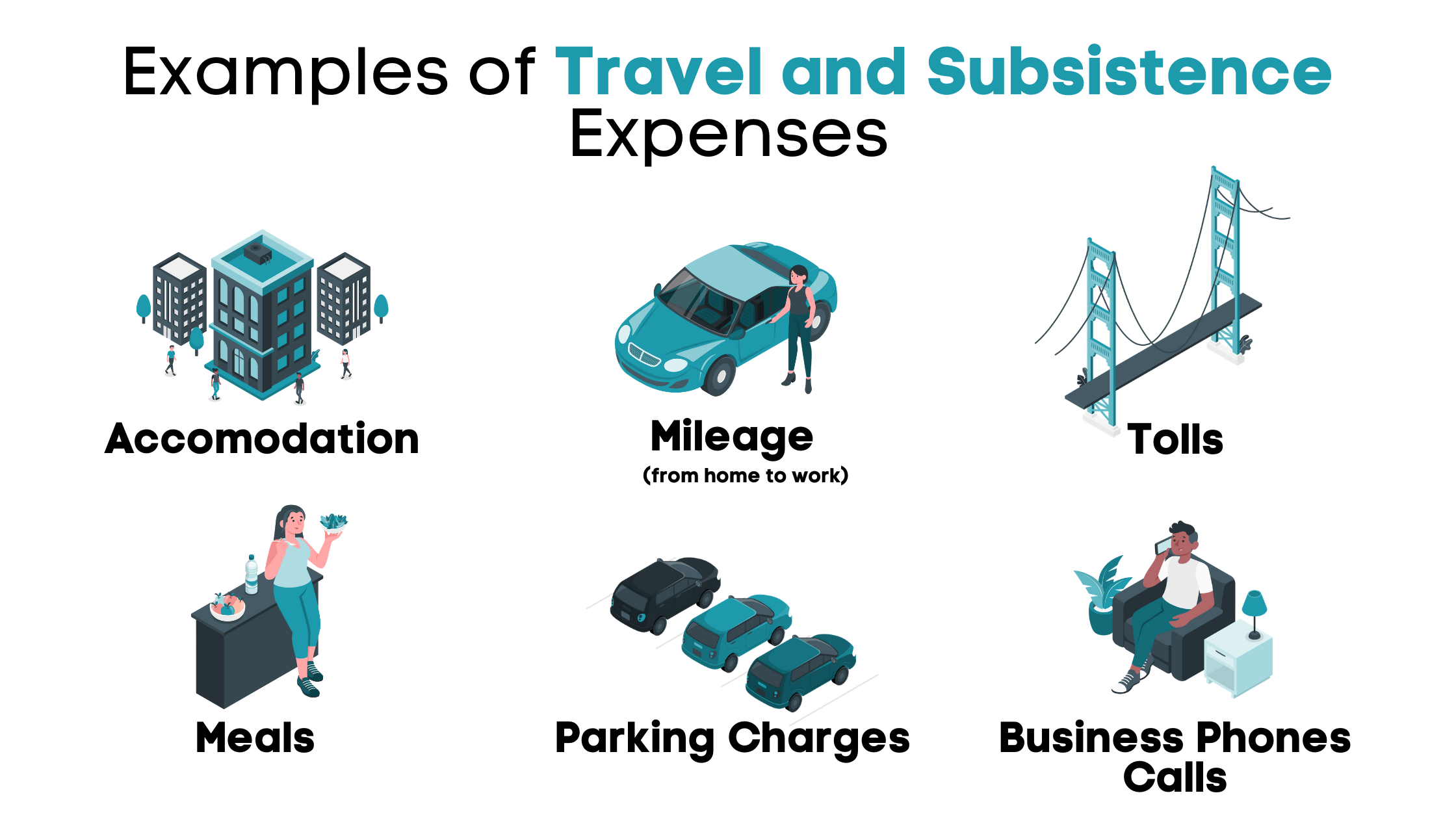

What are Travel and Subsistence Expenses?

We cover all these points in our post: Umbrella Companies and Expenses: How does it work? (2021).

Do you already know what they are? You are good to keep going then! 🙂

What is the Supervision, Direction and Control (SDC)?

Since the 6th of April 2016, a contractor engaged through an intermediary such as an Umbrella Company or Recruitment agency won’t be able to claim tax relief on travel and subsistence expenses. Obviously, if that were it, we wouldn’t write a post about it 🙂

Indeed, HMRC state that there is an exception: A contractor will still be able to claim tax relief on travel expenses from and to work and subsistence costs if they are not subject to Supervision, Direction OR Control (SDC). Fact Check on HMRC website under ESM5530

Let’s define these three elements that are Supervision, Direction and Control.

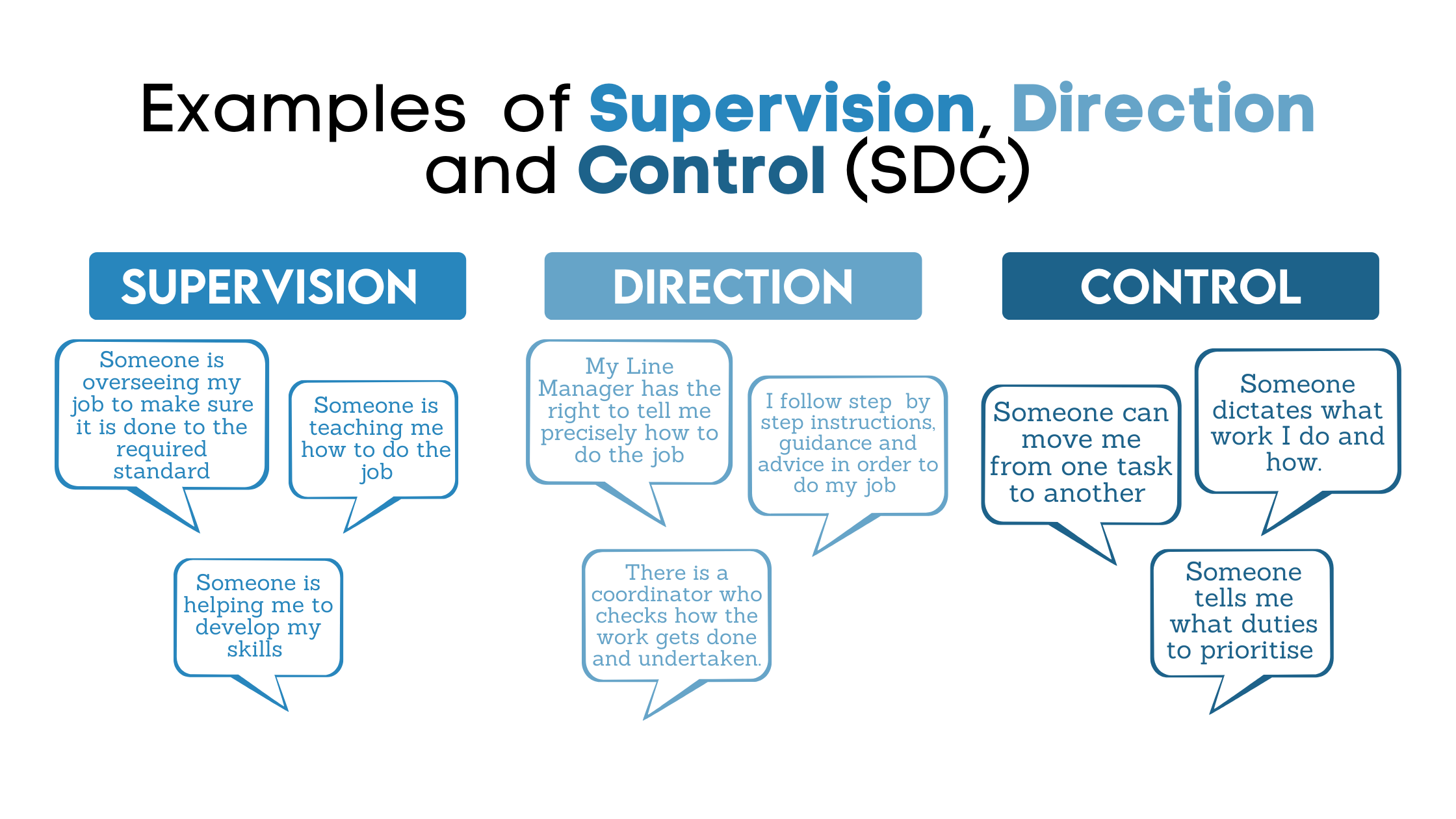

What does Supervision mean?

“Supervision is someone overseeing a person doing work, to ensure that person is doing the work they are required to do, and it is being done correctly to the required standard. Supervision can also involve helping the person where appropriate in order to develop their skills and knowledge.”

What does Direction mean?

“Direction is someone making a person do his/her work in a certain way by providing them with instructions, guidance or advice as to how the work must be done. Someone providing Direction will often coordinate how the work is done, as it is being undertaken.”

What does Control mean?

“Control is someone dictating what work a person does and how they go about doing that work. Control also includes someone having the power to move the person from one job to another.”

How can I determine my SDC Status?

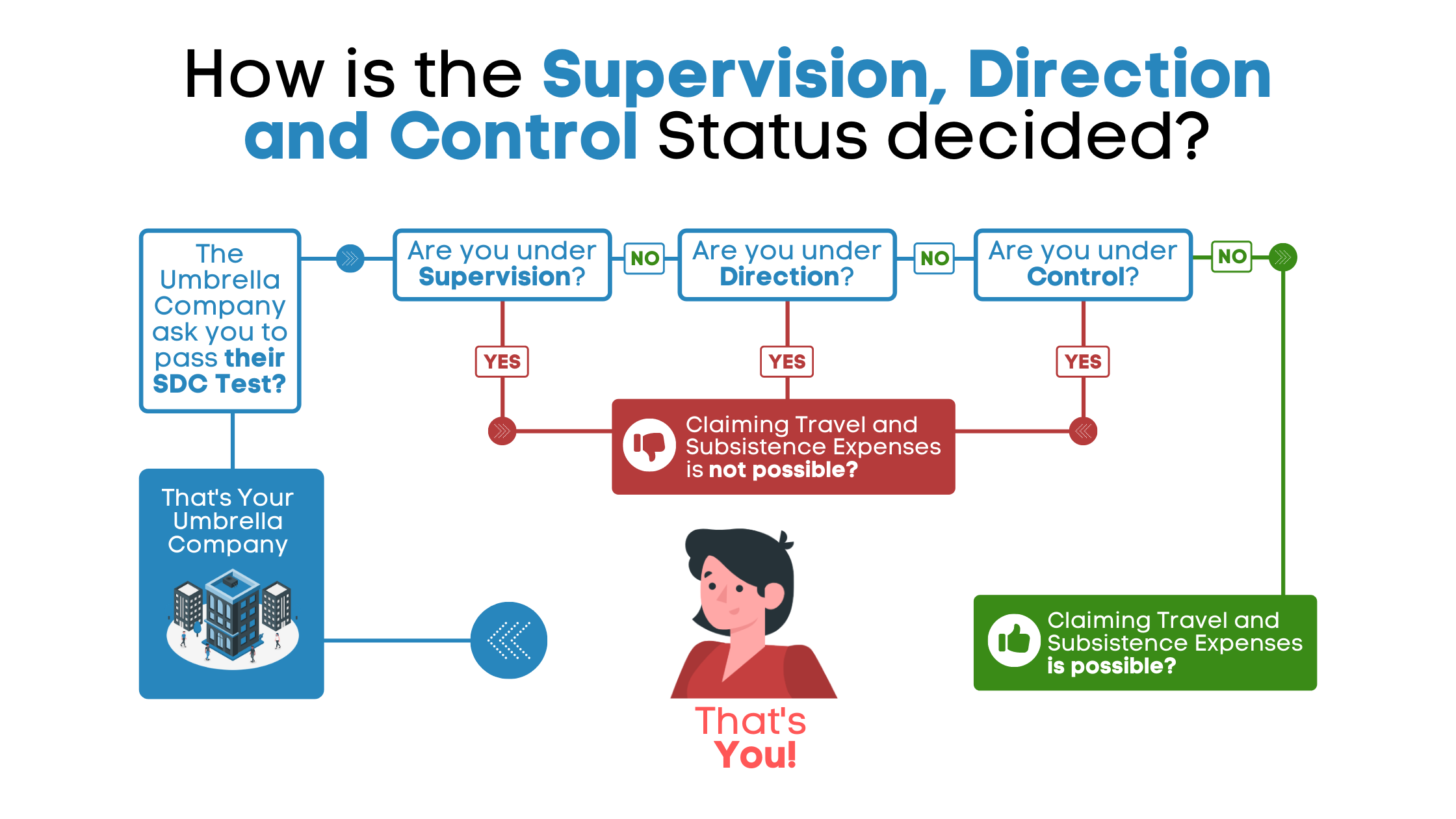

Before to dive into this question, it is essential to understand fully that HMRC presumes the SDC Test is met by default. It means that unless it can be shown otherwise, you will be under SDC and won’t be able to get tax reliefs.

To determine you are not subject to Supervision, Direction or Control, you will have to pass an SDC test.

HMRC clearly state that:

“There is no definition of the meaning of the SDC test in law”

— Source: HMRC

and therefore you will have to engage with your Umbrella Company or Recruitment Agency to receive one.

The onus is on the employment intermediaries and the worker so SDC tests might differ between employment intermediaries (recruitment agencies or umbrella companies).

In other words, no need to google: HMRC SDC Test 😊

5 important SDC rules

We listed here five facts about the Supervision, Direction and Control that you should not ignore:

- Only one part of the SDC test must be met. E.g. if you are under Supervision but not subject to Direction or Control, you will be caught under SDC and won’t be able to claim tax relief.

- You won’t have to be subject to Supervision, Direction or Control from any organisation of person, not only your line manager. It includes: *The client. *A recruitment agency, Umbrella company or other employment intermediaries. *Line managers, sites managers, project managers, etc

- Comply to follow statutory requirements are out of the equation as even a self-employed contractor must follow these rules. E.g. following health and safety procedures isn’t indicative of a right of Control. Indeed, permanent and self-employed workers must comply too.

- The SDC test focuses on the way a worker carries out the work. It is all about HOW the job is done and not what is being asked.

Who is liable for the SDC test result?

We know that some of you started having some “$” signs in your eyes when you read “exception” and “SDC test”. That is why it is important we properly cover who is eligible for this test. 😊

We guess HMRC saw that coming too as they recognised that Umbrella companies or recruitment agencies might provide fraudulent documents to demonstrate a worker is not under SDC. (Umbrellas and recruitment agencies might not be aware that documents provided are fraudulent)

HMRC is clear and unequivocal: the party providing the fraudulent document will be considered as the employer in relation to the tax due and will be held accountable. It could be:

- The contractor

- The Recruitment Agency, Umbrella Company or other employment intermediaries

- The End Client

- Any relevant person

Conclusion

You can still potentially claim Travel and Subsistence expenses if you work through an Umbrella Company. We hope we clarified how you could determine your SDC status. Don’t forget that you might be held liable if fraud occurs and this is where choosing an umbrella company with an accreditation is essential.

Start comparing dozens of Accredited Umbrella Companies now on the FindYourUmbrella Comparator (no sign-in required).