You are going to learn in this post what an Umbrella Company is and why so many contractors who fall inside IR35 will choose to swapp from their Limited Company to this option. If you are new to contracting, you are going to love the simplicity of our 5-minutes guide.

Right! Let’s dive into it!

How does an Umbrella Company works in UK?

What is an Umbrella Company

An Umbrella company or PAYE Umbrella is an easy payment solution available to contractors and freelancers, without having the hassle and complexity of owning a Limited Company. In a nutshell: when you register with an Umbrella Company, you essentially become an employee of this Umbrella Company with the same statutory benefits as a permanent worker.

How do Umbrella Companies work? What do they do?

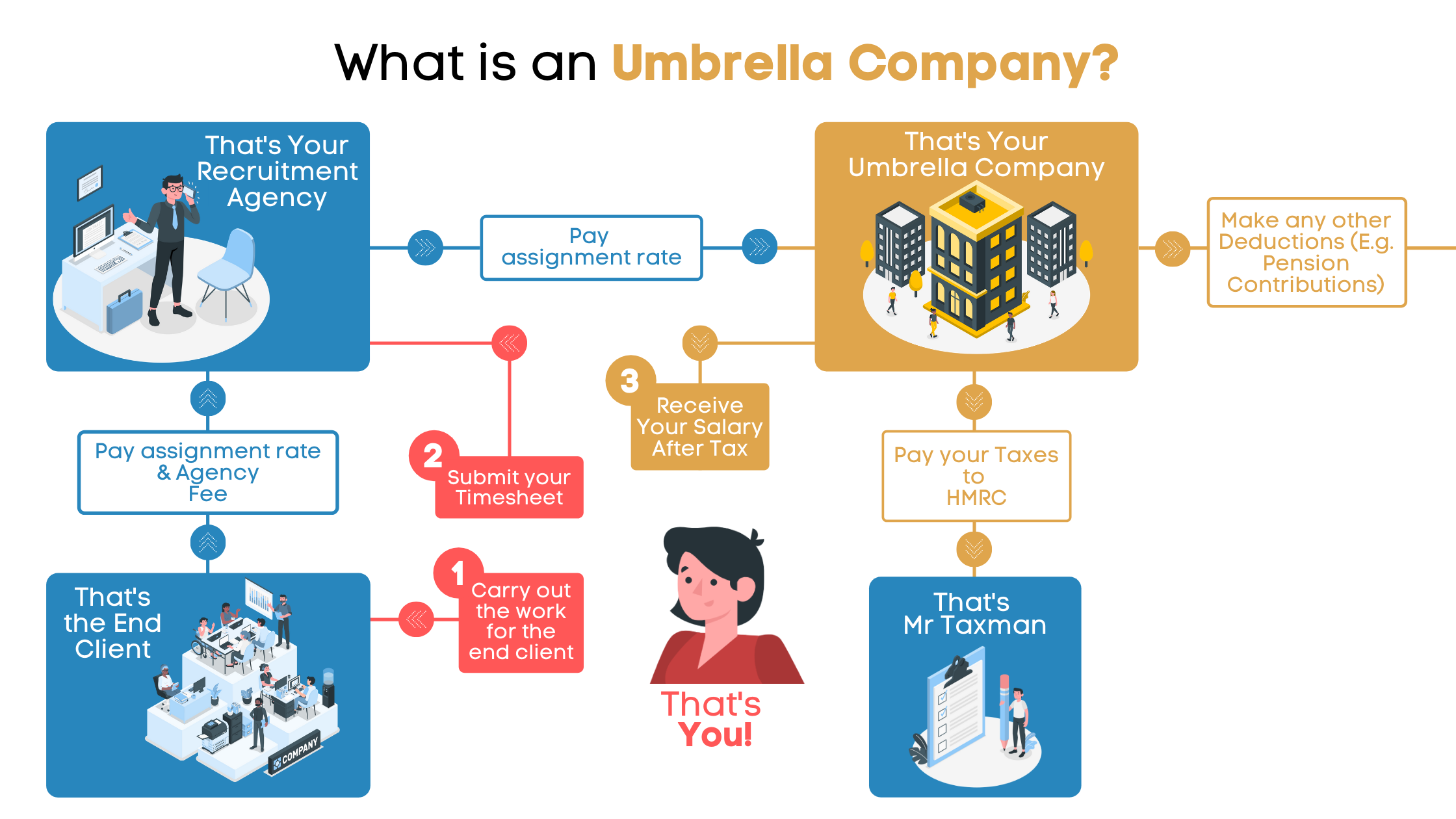

Their central and principal role is to organise payment for the contractor; taking away most of the administration involved if you had a Limited Company. In brief, the umbrella company will receive the payment for your timesheet from the End Client or the Recruitment Agency. They will then pay any taxes on your behalf to HMRC and send your net earnings directly to your bank account:

Any contractor can use an umbrella company, from nurses to supply teachers!

Why do contractors use Umbrella Companies?

In one word: simplicity!

Considering you are on the company’s payroll as an employee, being a contractor is as simple and easy as being in a permanent position. The only thing you have to do is find a job directly with an organisation or a recruitment agency. The time-saving aspect, coupled with a worry-free solution is why people are attracted to using this payroll solution.

List of the benefits of using an Umbrella Company:

- No administration or paperwork, the Umbrella Company is managing that for you.

- The Umbrella Company will send you weekly or monthly payslips to keep track of your earning.

- If you regularly change assignments, the umbrella company will maintain a continuous employment record which will make it easier for you to provide information to financial services such as when obtaining a loan or mortgage with your bank.

- You will accrue the same statutory benefits as a permanent worker employee, such as:

- Pension

- Holiday Pay

- Statutory sick pay

- Maternity

- Paternity pay

What is the BEST Umbrella Company?

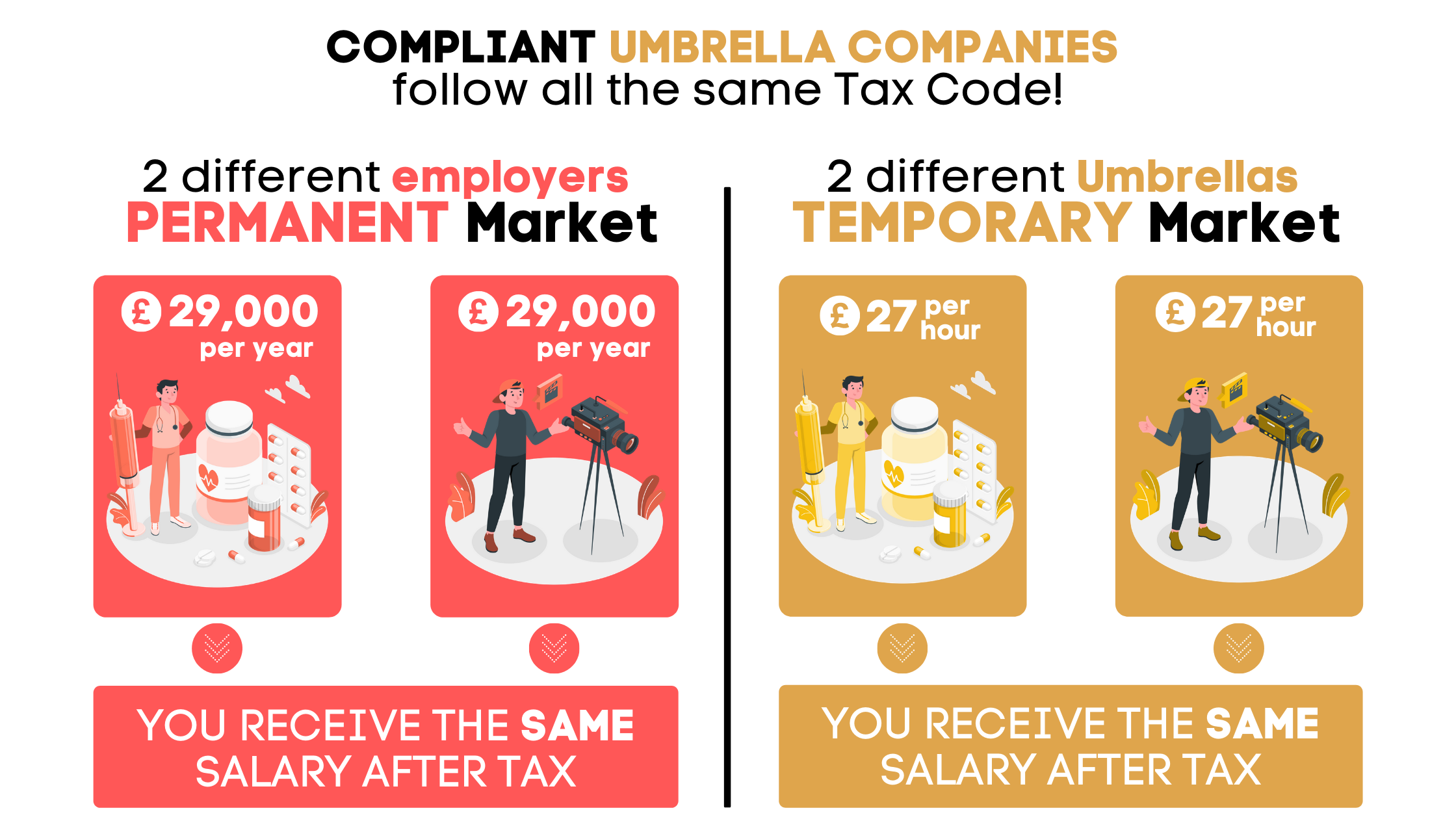

It is essential to understand that “best” cannot mean “significant higher take-home”. It is because the amount of tax you pay should be the same from one Umbrella Company to another. There is a good chance that if you read this, you have heard friends or colleagues talking about their chosen umbrella companies and how much more money they receive after tax. Just to reiterate: Your salary should be the same no matter which Umbrella Company you are working under.

Let me give you an example: imagine you are being offered two permanent positions with two organisations that are competitors. Both offers are precisely the same salary: £29,000 per year. Would you call both companies’ Finance departments to compare which one offers a higher take-home pay? You wouldn’t, you would expect to receive the same salary after tax. It is the same logic with Umbrella companies. Remember: “You are like a permanent employee of the Umbrella Company.” 😊

So I guess the question now is: “what makes an Umbrella Company better than another”. Well, everything else such as:

- Accreditations that offer you an additional guarantee that the Umbrella Company follows HMRC guidelines.

- Quality of the relationship you have with the Umbrella company.

- Reactivity when a problem occurs.

- Being notified by SMS that you are on the next payroll.

- Receiving advance payment in case of timesheet issues.

- ...

The answer is different for everyone because not everyone is looking for the same thing. If you want to see which one is best for you, you should check out our Accredited Umbrella Company comparator 😊

And if you are working through an umbrella company with a significant higher take-home pay than what you should get, you should check our post on how to make sure your Umbrella is compliant. Don’t forget you are legally responsible for paying the correct amount of tax. And if you don’t believe us, believe HRMC:

“You will be at risk if you use an umbrella company that involves tax avoidance. You’re legally responsible for your tax affairs and paying the correct amount of Income-tax and National Insurance contributions (NICs).”

— Source: HMRC

What is the cost of an Umbrella Company?

Umbrella Companies are private organisations and they need to make money for the service they provide. Umbrella Companies fees and recurrence can be very different depending on the Umbrella Company.

The cost is, most of the time, a fixed fee per timesheet. It varies but is generally around £15 to £25/week mark.

It is essential to understand that for compliant Umbrella Companies, their cost/margin will be their main source of revenue.

At FindYourUmbrella, we don’t think the cost should fully drive your decision to pick an Umbrella Company over another. A low cost (i.e. some umbrella companies charge £2.50/week) could be an indication that the umbrella company is making a margin somewhere else on your salary without your knowledge.

Conclusion

There is no doubt; Umbrella Companies are a viable option for contractors; even more with IR35 about to be applicable in just a few months.

Our advice is always to double-check what taxes the Umbrella Company is paying on your behalf.